Python: two examples

Utilizzo l’environment conda py3

1

~$ conda activate py3

Versione modulo installato

1

2

3

4

5

6

7

8

9

10

11

~$ pip show pandas_datareader

Name: pandas-datareader

Version: 0.9.0

Summary: Data readers extracted from the pandas codebase,should be compatible with recent pandas versions

Home-page: https://github.com/pydata/pandas-datareader

Author: The PyData Development Team

Author-email: pydata@googlegroups.com

License: BSD License

Location: /home/user/miniconda3/envs/py3/lib/python3.7/site-packages

Requires: requests, pandas, lxml

Required-by:

Indice

Due laboratori

911 Calls Project

Kaggle data

1

2

3

4

5

6

7

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

%matplotlib inline

1

2

3

# import df

df = pd.read_csv('911.csv')

df.head()

| lat | lng | desc | zip | title | timeStamp | twp | addr | e | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | 40.297876 | -75.581294 | REINDEER CT & DEAD END; NEW HANOVER; Station ... | 19525.0 | EMS: BACK PAINS/INJURY | 2015-12-10 17:40:00 | NEW HANOVER | REINDEER CT & DEAD END | 1 |

| 1 | 40.258061 | -75.264680 | BRIAR PATH & WHITEMARSH LN; HATFIELD TOWNSHIP... | 19446.0 | EMS: DIABETIC EMERGENCY | 2015-12-10 17:40:00 | HATFIELD TOWNSHIP | BRIAR PATH & WHITEMARSH LN | 1 |

| 2 | 40.121182 | -75.351975 | HAWS AVE; NORRISTOWN; 2015-12-10 @ 14:39:21-St... | 19401.0 | Fire: GAS-ODOR/LEAK | 2015-12-10 17:40:00 | NORRISTOWN | HAWS AVE | 1 |

| 3 | 40.116153 | -75.343513 | AIRY ST & SWEDE ST; NORRISTOWN; Station 308A;... | 19401.0 | EMS: CARDIAC EMERGENCY | 2015-12-10 17:40:01 | NORRISTOWN | AIRY ST & SWEDE ST | 1 |

| 4 | 40.251492 | -75.603350 | CHERRYWOOD CT & DEAD END; LOWER POTTSGROVE; S... | NaN | EMS: DIZZINESS | 2015-12-10 17:40:01 | LOWER POTTSGROVE | CHERRYWOOD CT & DEAD END | 1 |

1

df.info()

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 99492 entries, 0 to 99491

Data columns (total 9 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 lat 99492 non-null float64

1 lng 99492 non-null float64

2 desc 99492 non-null object

3 zip 86637 non-null float64

4 title 99492 non-null object

5 timeStamp 99492 non-null object

6 twp 99449 non-null object

7 addr 98973 non-null object

8 e 99492 non-null int64

dtypes: float64(3), int64(1), object(5)

memory usage: 6.8+ MB

1

2

# top 5 zipcode for 911 cals

df['zip'].value_counts().head()

1

2

3

4

5

6

19401.0 6979

19464.0 6643

19403.0 4854

19446.0 4748

19406.0 3174

Name: zip, dtype: int64

1

2

# top 5 townships (twp) for 911 calls

df['twp'].value_counts().head()

1

2

3

4

5

6

LOWER MERION 8443

ABINGTON 5977

NORRISTOWN 5890

UPPER MERION 5227

CHELTENHAM 4575

Name: twp, dtype: int64

1

2

3

# unique title codes

# len(df['title'].unique())

df['title'].nunique()

1

110

1

2

# 'Reasons/Departments' extraction from title

df['Reason'] = df['title'].apply(lambda x: x.split(':')[0])

1

2

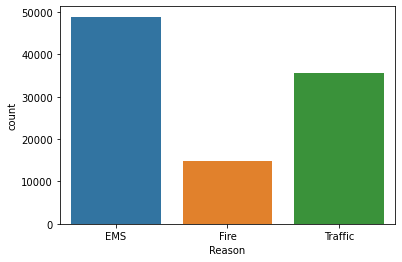

# frequency table of 'Reasons/Departments'

df['Reason'].value_counts()

1

2

3

4

EMS 48877

Traffic 35695

Fire 14920

Name: Reason, dtype: int64

1

2

# countplot with seaborn

sns.countplot(x='Reason', data=df)

1

<matplotlib.axes._subplots.AxesSubplot at 0x7ff700edb9d0>

1

2

# timeStamp

df['timeStamp'][0]

1

'2015-12-10 17:40:00'

1

2

# data type of the objects in the timeStamp column

type(df['timeStamp'][0])

1

str

1

2

3

# convert timeStamp string to DateTime

df['timeStamp'] = pd.to_datetime(df['timeStamp'])

df['timeStamp'][0]

1

Timestamp('2015-12-10 17:40:00')

1

2

# assegno la prima osservazione, così posso usare shift+tab nella cella successiva per vedere i methods

ora = df['timeStamp'][0]

1

2

# estraggo l'ora

ora.hour

1

17

1

2

3

4

# costruisco variabile ora, mese e giorno della settimana

df['Hour'] = df['timeStamp'].apply(lambda x: x.hour)

df['Month'] = df['timeStamp'].apply(lambda x: x.month)

df['Day of Week'] = df['timeStamp'].apply(lambda x: x.dayofweek)

1

2

3

# mapping number day week to day week

dmap = {0:'Mon',1:'Tue',2:'Wed',3:'Thu',4:'Fri',5:'Sat',6:'Sun'}

df['Day of Week'] = df['Day of Week'].map(dmap)

1

2

3

4

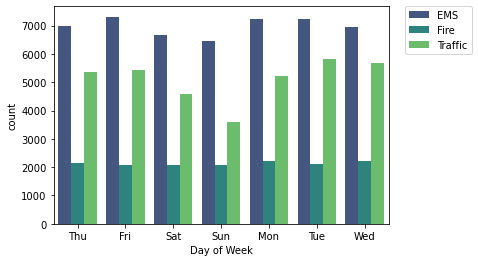

# countplot day week

sns.countplot(x='Day of Week',data=df,hue='Reason',palette='viridis')

# plt.legend(loc='center left', bbox_to_anchor=(1.0, 0.5))

plt.legend(bbox_to_anchor=(1.05, 1), loc=2, borderaxespad=0.)

1

<matplotlib.legend.Legend at 0x7ff6fffce450>

1

2

3

4

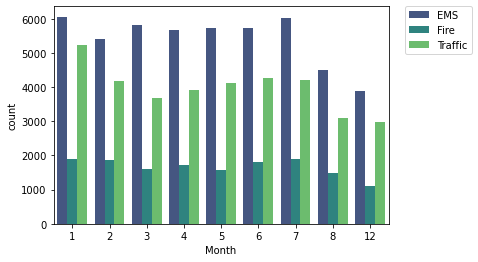

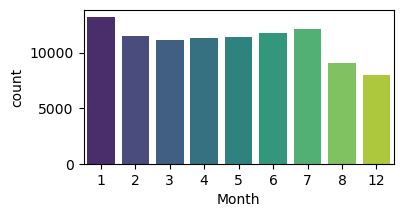

# countplot month

sns.countplot(x='Month',data=df,hue='Reason',palette='viridis')

# plt.legend(loc='center left', bbox_to_anchor=(1.0, 0.5))

plt.legend(bbox_to_anchor=(1.05, 1), loc=2, borderaxespad=0.)

1

<matplotlib.legend.Legend at 0x7ff6ff24ea50>

1

# 9-10-11 months missing

1

2

# attenzione sono presenti dei missing, non usare le colonne con i missing per i conteggi

df.isnull().sum()

1

2

3

4

5

6

7

8

9

10

11

12

13

14

lat 0

lng 0

desc 0

zip 12855

title 0

timeStamp 0

twp 43

addr 519

e 0

Reason 0

Hour 0

Month 0

Day of Week 0

dtype: int64

1

2

# attenzione sono presenti dei missing, non usare le colonne con i missing per i conteggi

df.isnull().any()

1

2

3

4

5

6

7

8

9

10

11

12

13

14

lat False

lng False

desc False

zip True

title False

timeStamp False

twp True

addr True

e False

Reason False

Hour False

Month False

Day of Week False

dtype: bool

1

2

3

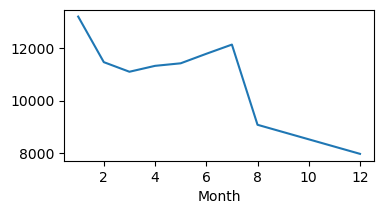

# groupby month

byMonth = df.groupby(by='Month').count()

byMonth.head()

| lat | lng | desc | zip | title | timeStamp | twp | addr | e | Reason | Hour | Day of Week | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Month | ||||||||||||

| 1 | 13205 | 13205 | 13205 | 11527 | 13205 | 13205 | 13203 | 13096 | 13205 | 13205 | 13205 | 13205 |

| 2 | 11467 | 11467 | 11467 | 9930 | 11467 | 11467 | 11465 | 11396 | 11467 | 11467 | 11467 | 11467 |

| 3 | 11101 | 11101 | 11101 | 9755 | 11101 | 11101 | 11092 | 11059 | 11101 | 11101 | 11101 | 11101 |

| 4 | 11326 | 11326 | 11326 | 9895 | 11326 | 11326 | 11323 | 11283 | 11326 | 11326 | 11326 | 11326 |

| 5 | 11423 | 11423 | 11423 | 9946 | 11423 | 11423 | 11420 | 11378 | 11423 | 11423 | 11423 | 11423 |

1

2

3

4

# line plot count, è evidente la caduta causata dal dato mancante

plt.figure(figsize=(4,2),dpi=100)

plt.style.use('default')

byMonth['lat'].plot()

1

<matplotlib.axes._subplots.AxesSubplot at 0x7ff703e0eed0>

1

2

3

# count plot, è evidente la caduta causata dal dato mancante

plt.figure(figsize=(4,2),dpi=100)

sns.countplot(x='Month',data=df,palette='viridis')

1

<matplotlib.axes._subplots.AxesSubplot at 0x7ff6ff5d5c50>

1

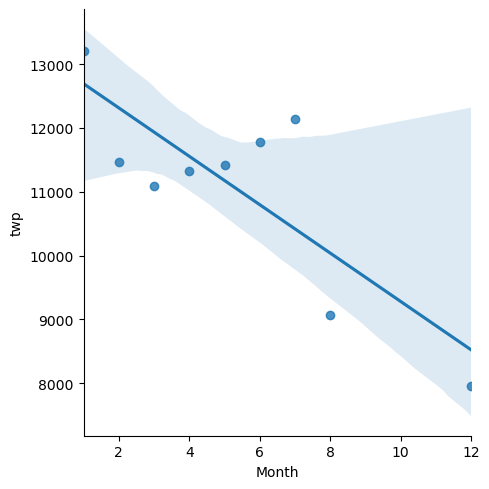

2

3

# linear fit calls per month

# trasformo l'index month in una colonna così da poterlo usare come variabile x

sns.lmplot(x='Month',y='twp',data=byMonth.reset_index())

1

<seaborn.axisgrid.FacetGrid at 0x7ff6ff5a60d0>

1

2

3

# creo colonna data da timeStamp

df['Date'] = df['timeStamp'].apply(lambda x: x.date())

df['Date'].head()

1

2

3

4

5

6

0 2015-12-10

1 2015-12-10

2 2015-12-10

3 2015-12-10

4 2015-12-10

Name: Date, dtype: object

1

2

3

4

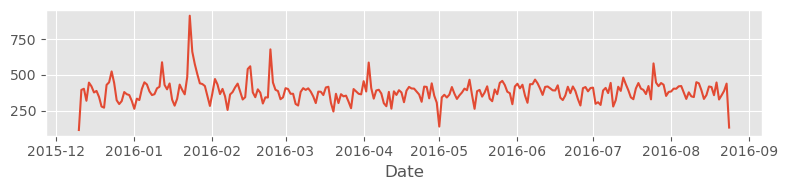

5

# line plot time

plt.figure(figsize=(8,2),dpi=100)

plt.style.use('ggplot') # plt.style.use('default')

df.groupby(by='Date').count()['twp'].plot()

plt.tight_layout()

1

2

3

4

5

6

7

8

9

10

11

12

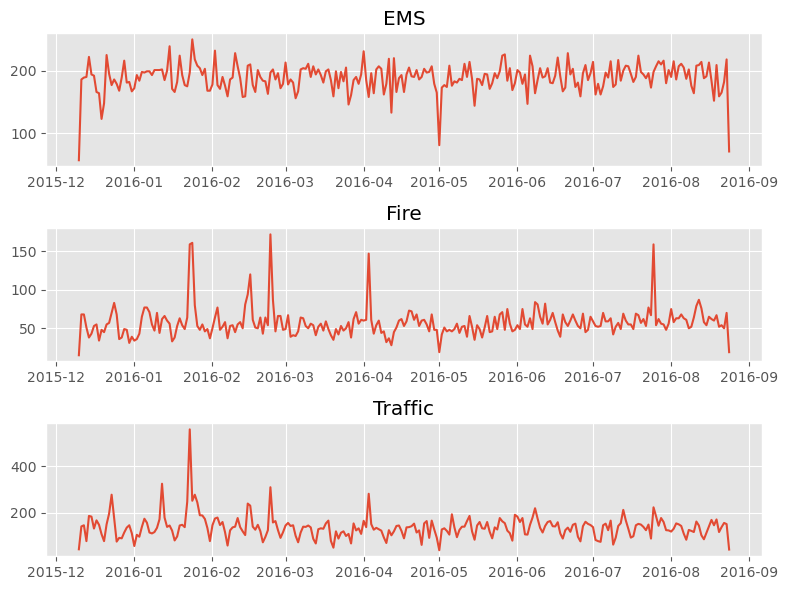

13

# plot per ogni Reason

fig,axes = plt.subplots(nrows=3,ncols=1,figsize=(8,6))

axes[0].plot(df[df['Reason']=='EMS'].groupby(by='Date').count()['twp'])

axes[0].set_title('EMS')

axes[1].plot(df[df['Reason']=='Fire'].groupby(by='Date').count()['twp'])

axes[1].set_title('Fire')

axes[2].plot(df[df['Reason']=='Traffic'].groupby(by='Date').count()['twp'])

axes[2].set_title('Traffic')

plt.tight_layout()

1

2

3

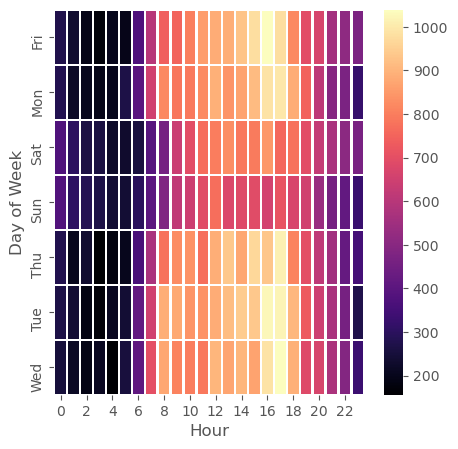

# heatmap column Hours & Index Day of the Week (prepare data - metodo 1)

dayHour = df[['Day of Week','Hour']].pivot_table(index='Day of Week',columns='Hour',values='Day of Week',aggfunc=len)

dayHour

| Hour | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | ... | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Day of Week | |||||||||||||||||||||

| Fri | 275 | 235 | 191 | 175 | 201 | 194 | 372 | 598 | 742 | 752 | ... | 932 | 980 | 1039 | 980 | 820 | 696 | 667 | 559 | 514 | 474 |

| Mon | 282 | 221 | 201 | 194 | 204 | 267 | 397 | 653 | 819 | 786 | ... | 869 | 913 | 989 | 997 | 885 | 746 | 613 | 497 | 472 | 325 |

| Sat | 375 | 301 | 263 | 260 | 224 | 231 | 257 | 391 | 459 | 640 | ... | 789 | 796 | 848 | 757 | 778 | 696 | 628 | 572 | 506 | 467 |

| Sun | 383 | 306 | 286 | 268 | 242 | 240 | 300 | 402 | 483 | 620 | ... | 684 | 691 | 663 | 714 | 670 | 655 | 537 | 461 | 415 | 330 |

| Thu | 278 | 202 | 233 | 159 | 182 | 203 | 362 | 570 | 777 | 828 | ... | 876 | 969 | 935 | 1013 | 810 | 698 | 617 | 553 | 424 | 354 |

| Tue | 269 | 240 | 186 | 170 | 209 | 239 | 415 | 655 | 889 | 880 | ... | 943 | 938 | 1026 | 1019 | 905 | 731 | 647 | 571 | 462 | 274 |

| Wed | 250 | 216 | 189 | 209 | 156 | 255 | 410 | 701 | 875 | 808 | ... | 904 | 867 | 990 | 1037 | 894 | 686 | 668 | 575 | 490 | 335 |

7 rows × 24 columns

1

2

3

# heatmap column Hours & Index Day of the Week (prepare data - metodo 2)

dayHour = df.groupby(by=['Day of Week','Hour']).count()['Reason'].unstack(level=-1)

dayHour

| Hour | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | ... | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Day of Week | |||||||||||||||||||||

| Fri | 275 | 235 | 191 | 175 | 201 | 194 | 372 | 598 | 742 | 752 | ... | 932 | 980 | 1039 | 980 | 820 | 696 | 667 | 559 | 514 | 474 |

| Mon | 282 | 221 | 201 | 194 | 204 | 267 | 397 | 653 | 819 | 786 | ... | 869 | 913 | 989 | 997 | 885 | 746 | 613 | 497 | 472 | 325 |

| Sat | 375 | 301 | 263 | 260 | 224 | 231 | 257 | 391 | 459 | 640 | ... | 789 | 796 | 848 | 757 | 778 | 696 | 628 | 572 | 506 | 467 |

| Sun | 383 | 306 | 286 | 268 | 242 | 240 | 300 | 402 | 483 | 620 | ... | 684 | 691 | 663 | 714 | 670 | 655 | 537 | 461 | 415 | 330 |

| Thu | 278 | 202 | 233 | 159 | 182 | 203 | 362 | 570 | 777 | 828 | ... | 876 | 969 | 935 | 1013 | 810 | 698 | 617 | 553 | 424 | 354 |

| Tue | 269 | 240 | 186 | 170 | 209 | 239 | 415 | 655 | 889 | 880 | ... | 943 | 938 | 1026 | 1019 | 905 | 731 | 647 | 571 | 462 | 274 |

| Wed | 250 | 216 | 189 | 209 | 156 | 255 | 410 | 701 | 875 | 808 | ... | 904 | 867 | 990 | 1037 | 894 | 686 | 668 | 575 | 490 | 335 |

7 rows × 24 columns

1

2

3

# heatmap column Hours & Index Day of the Week

plt.figure(figsize=(5,5))

sns.heatmap(dayHour,cmap='magma',linecolor='white',linewidths=1)

1

<matplotlib.axes._subplots.AxesSubplot at 0x7ff6ff321a90>

1

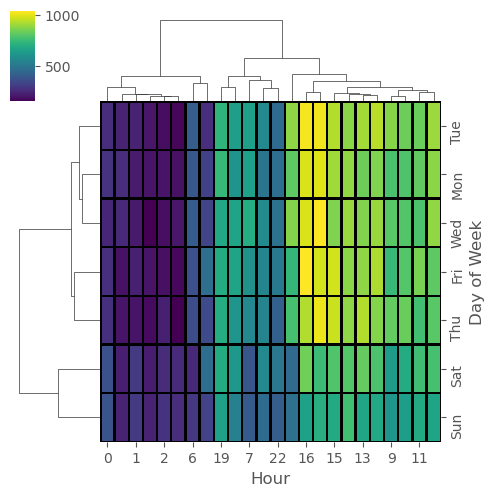

2

# clustermap column Hours & Index Day of the Week

sns.clustermap(dayHour,cmap='viridis',linecolor='black',linewidths=1,figsize=(5,5))

1

<seaborn.matrix.ClusterGrid at 0x7ff6feffc690>

1

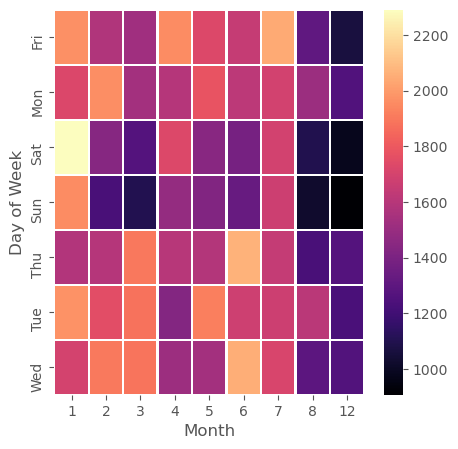

2

3

4

# heatmap column Hours & Index Day of the Week

dayMonth = df.groupby(by=['Day of Week','Month']).count()['Reason'].unstack(level=-1)

plt.figure(figsize=(5,5))

sns.heatmap(dayMonth,cmap='magma',linecolor='white',linewidths=1)

1

<matplotlib.axes._subplots.AxesSubplot at 0x7ff6fe48b310>

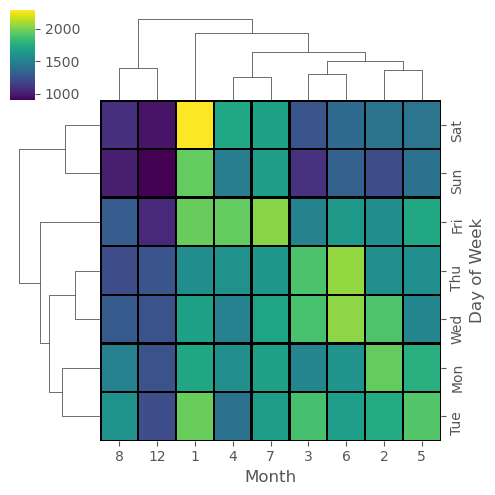

1

2

# clustermap column Month & Index Day of the Week

sns.clustermap(dayMonth,cmap='viridis',linecolor='black',linewidths=1,figsize=(5,5))

1

<seaborn.matrix.ClusterGrid at 0x7ff6fe3ba150>

Finance Project

Read data from Google finance with pandas-datareader

Documentazione pandas-datareader remote_data

1

2

3

4

5

6

7

8

9

10

from pandas_datareader import data, wb

import pandas as pd

import numpy as np

import datetime

import matplotlib.pyplot as plt

import seaborn as sns

%matplotlib inline

Aggiunta 16/04/2021

Per scaricare indici di borsa torna comodo yfinance che ha una granularità anche del minuto ma con un limite di download massimo di 7 giorni.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

import yfinance as yf

import datetime

FTSEMIB = yf.download(tickers="FTSEMIB.MI",

start=datetime.datetime(2021, 4, 14),

end=datetime.datetime(2021, 4, 16),

interval="1m").sort_values(by='Datetime', ascending=False).head()

NASDAQ = yf.download(tickers="^IXIC",

start=datetime.datetime(2021, 4, 14),

end=datetime.datetime(2021, 4, 16),

interval="1m").sort_values(by='Datetime', ascending=False).head()

BITCOIN_USD = yf.download(tickers="BTC-USD",

start=datetime.datetime(2021, 4, 14),

end=datetime.datetime(2021, 4, 16),

interval="1m").sort_values(by='Datetime', ascending=False).head()

TESLA = yf.download(tickers="TSLA",

start=datetime.datetime(2021, 4, 14),

end=datetime.datetime(2021, 4, 16),

interval="1m").sort_values(by='Datetime', ascending=False).head()

Riprendendo l’esercitazione..

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

# download data

start = datetime.datetime(2006, 1, 1)

end = datetime.datetime(2016, 1, 1)

BAC = data.DataReader('BAC', 'yahoo', start, end) # Bank of America

C = data.DataReader('C', 'yahoo', start, end) # CitiGroup

GS = data.DataReader('GS', 'yahoo', start, end) # Goldman Sachs

JPM = data.DataReader('JPM', 'yahoo', start, end) # JPMorgan Chase

MS = data.DataReader('MS', 'yahoo', start, end) # Morgan Stanley

WFC = data.DataReader('WFC', 'yahoo', start, end) # Wells Fargo

# per scaricarli tutti in un comando

# df = data.DataReader(['BAC', 'C', 'GS', 'JPM', 'MS', 'WFC'],'yahoo', start, end)

# nel caso in cui non vada l'import (nb. qui CitiGroup presenta un dato anomalo eccessivo 'Stock Split C')

# df = pd.read_pickle('all_banks')

1

2

3

# lista delle sigle banche ordinata

tickers = sorted(['C', 'BAC','JPM','GS','MS','WFC'])

tickers

1

['BAC', 'C', 'GS', 'JPM', 'MS', 'WFC']

1

2

3

# creo df unico

bank_stocks = pd.concat([BAC, C, GS, JPM, MS, WFC],axis=1,keys=tickers)

bank_stocks.head()

| BAC | C | ... | MS | WFC | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| High | Low | Open | Close | Volume | Adj Close | High | Low | Open | Close | ... | Open | Close | Volume | Adj Close | High | Low | Open | Close | Volume | Adj Close | |

| Date | |||||||||||||||||||||

| 2006-01-03 | 47.180000 | 46.150002 | 46.919998 | 47.080002 | 16296700.0 | 35.054218 | 493.799988 | 481.100006 | 490.000000 | 492.899994 | ... | 57.169998 | 58.310001 | 5377000.0 | 37.399338 | 31.975000 | 31.195000 | 31.600000 | 31.900000 | 11016400.0 | 20.408512 |

| 2006-01-04 | 47.240002 | 46.450001 | 47.000000 | 46.580002 | 17757900.0 | 34.681938 | 491.000000 | 483.500000 | 488.600006 | 483.799988 | ... | 58.700001 | 58.349998 | 7977800.0 | 37.424999 | 31.820000 | 31.365000 | 31.799999 | 31.530001 | 10870000.0 | 20.171795 |

| 2006-01-05 | 46.830002 | 46.320000 | 46.580002 | 46.639999 | 14970700.0 | 34.726604 | 487.799988 | 484.000000 | 484.399994 | 486.200012 | ... | 58.549999 | 58.509998 | 5778000.0 | 37.527611 | 31.555000 | 31.309999 | 31.500000 | 31.495001 | 10158000.0 | 20.149401 |

| 2006-01-06 | 46.910000 | 46.349998 | 46.799999 | 46.570000 | 12599800.0 | 34.674480 | 489.000000 | 482.000000 | 488.799988 | 486.200012 | ... | 58.770000 | 58.570000 | 6889800.0 | 37.566090 | 31.775000 | 31.385000 | 31.580000 | 31.680000 | 8403800.0 | 20.267757 |

| 2006-01-09 | 46.970001 | 46.360001 | 46.720001 | 46.599998 | 15619400.0 | 34.696808 | 487.399994 | 483.000000 | 486.000000 | 483.899994 | ... | 58.630001 | 59.189999 | 4144500.0 | 37.963749 | 31.825001 | 31.555000 | 31.674999 | 31.674999 | 5619600.0 | 20.264565 |

5 rows × 36 columns

1

2

3

# definisco i nomi colonna del multilevel df

bank_stocks.columns.names = ['Bank Ticker','Stock Info']

bank_stocks.columns.names

1

FrozenList(['Bank Ticker', 'Stock Info'])

EDA (Exploratory Data Analysis)

Documentazione Multi-Level Indexing and Cross Section

1

bank_stocks.head()

| Bank Ticker | BAC | C | ... | MS | WFC | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stock Info | High | Low | Open | Close | Volume | Adj Close | High | Low | Open | Close | ... | Open | Close | Volume | Adj Close | High | Low | Open | Close | Volume | Adj Close |

| Date | |||||||||||||||||||||

| 2006-01-03 | 47.180000 | 46.150002 | 46.919998 | 47.080002 | 16296700.0 | 35.054218 | 493.799988 | 481.100006 | 490.000000 | 492.899994 | ... | 57.169998 | 58.310001 | 5377000.0 | 37.399338 | 31.975000 | 31.195000 | 31.600000 | 31.900000 | 11016400.0 | 20.408512 |

| 2006-01-04 | 47.240002 | 46.450001 | 47.000000 | 46.580002 | 17757900.0 | 34.681938 | 491.000000 | 483.500000 | 488.600006 | 483.799988 | ... | 58.700001 | 58.349998 | 7977800.0 | 37.424999 | 31.820000 | 31.365000 | 31.799999 | 31.530001 | 10870000.0 | 20.171795 |

| 2006-01-05 | 46.830002 | 46.320000 | 46.580002 | 46.639999 | 14970700.0 | 34.726604 | 487.799988 | 484.000000 | 484.399994 | 486.200012 | ... | 58.549999 | 58.509998 | 5778000.0 | 37.527611 | 31.555000 | 31.309999 | 31.500000 | 31.495001 | 10158000.0 | 20.149401 |

| 2006-01-06 | 46.910000 | 46.349998 | 46.799999 | 46.570000 | 12599800.0 | 34.674480 | 489.000000 | 482.000000 | 488.799988 | 486.200012 | ... | 58.770000 | 58.570000 | 6889800.0 | 37.566090 | 31.775000 | 31.385000 | 31.580000 | 31.680000 | 8403800.0 | 20.267757 |

| 2006-01-09 | 46.970001 | 46.360001 | 46.720001 | 46.599998 | 15619400.0 | 34.696808 | 487.399994 | 483.000000 | 486.000000 | 483.899994 | ... | 58.630001 | 59.189999 | 4144500.0 | 37.963749 | 31.825001 | 31.555000 | 31.674999 | 31.674999 | 5619600.0 | 20.264565 |

5 rows × 36 columns

1

2

# Close price massimo per ciascuna banca

bank_stocks.xs(key='Close',level='Stock Info',axis=1).max()

1

2

3

4

5

6

7

8

Bank Ticker

BAC 54.900002

C 564.099976

GS 247.919998

JPM 70.080002

MS 89.300003

WFC 58.520000

dtype: float64

Formula rendimenti \(r_t = \frac{p_t - p_{t-1}}{p_{t-1}} = \frac{p_t}{p_{t-1}} - 1\)

1

2

3

4

5

6

7

8

# calcolo dei Rendimenti

returns = bank_stocks.xs(key='Close',level='Stock Info',axis=1).pct_change()

returns.columns = returns.columns+' Return'

# returns = pd.DataFrame()

# for tick in tickers:

# returns[tick+' Return'] = bank_stocks[tick]['Close'].pct_change()

returns.head()

| Bank Ticker | BAC Return | C Return | GS Return | JPM Return | MS Return | WFC Return |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2006-01-03 | NaN | NaN | NaN | NaN | NaN | NaN |

| 2006-01-04 | -0.010620 | -0.018462 | -0.013812 | -0.014183 | 0.000686 | -0.011599 |

| 2006-01-05 | 0.001288 | 0.004961 | -0.000393 | 0.003029 | 0.002742 | -0.001110 |

| 2006-01-06 | -0.001501 | 0.000000 | 0.014169 | 0.007046 | 0.001025 | 0.005874 |

| 2006-01-09 | 0.000644 | -0.004731 | 0.012030 | 0.016242 | 0.010586 | -0.000158 |

1

2

# Citigroup has no 'great' outliers

returns['C Return'].describe()

1

2

3

4

5

6

7

8

9

count 2516.000000

mean -0.000157

std 0.038672

min -0.390244

25% -0.011182

50% -0.000210

75% 0.010751

max 0.578249

Name: C Return, dtype: float64

1

2

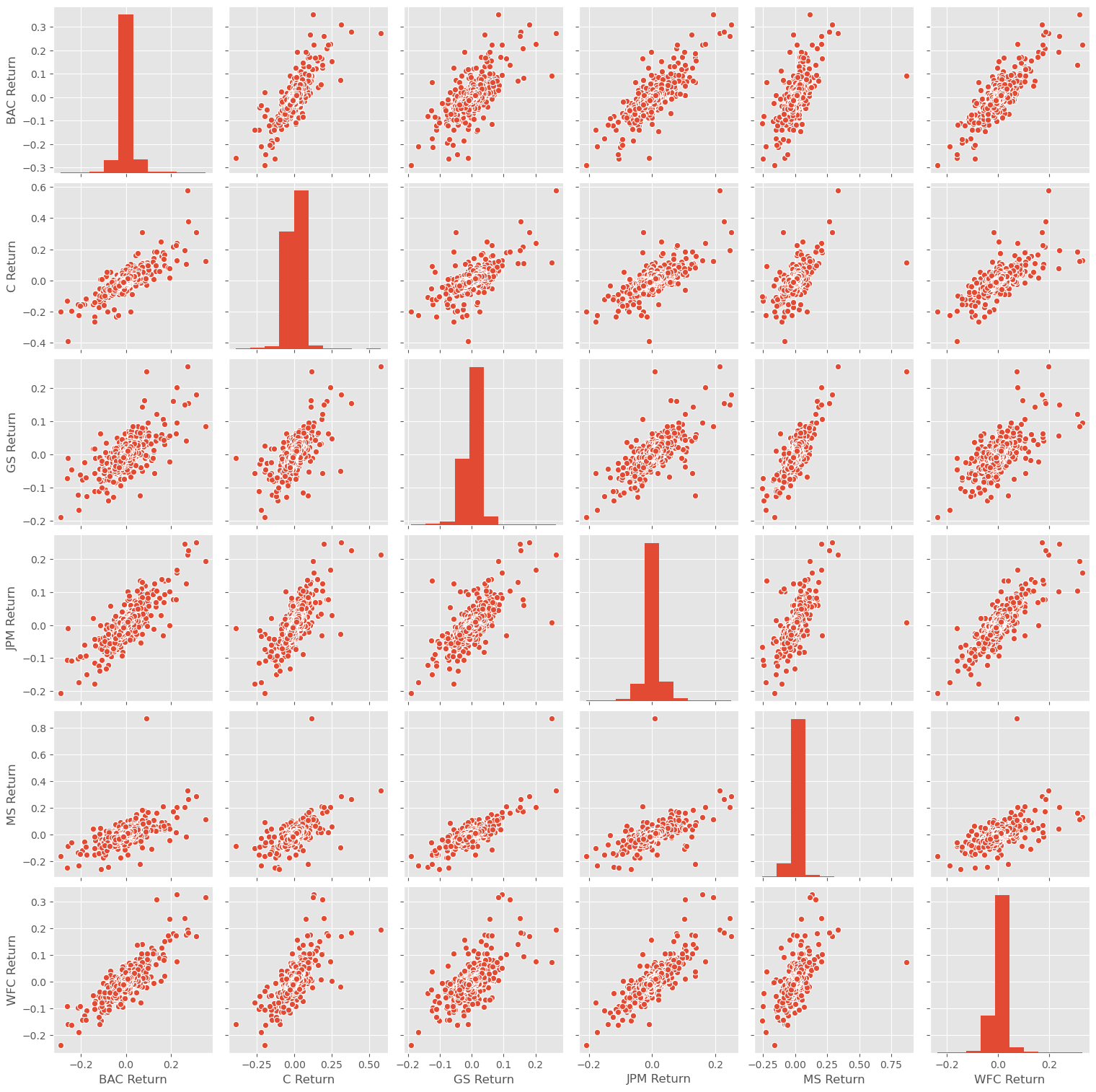

# pairplot

sns.pairplot(returns)

1

<seaborn.axisgrid.PairGrid at 0x7ff6d75a6bd0>

1

2

# Worst Drop (4 of them on Inauguration day)

returns.idxmin()

1

2

3

4

5

6

7

8

Bank Ticker

BAC Return 2009-01-20

C Return 2009-02-27

GS Return 2009-01-20

JPM Return 2009-01-20

MS Return 2008-10-09

WFC Return 2009-01-20

dtype: datetime64[ns]

1

2

# Best Single Day Gain (JPM e MS il migliore poco dopo)

returns.idxmax()

1

2

3

4

5

6

7

8

Bank Ticker

BAC Return 2009-04-09

C Return 2008-11-24

GS Return 2008-11-24

JPM Return 2009-01-21

MS Return 2008-10-13

WFC Return 2008-07-16

dtype: datetime64[ns]

1

2

# standard deviation intero periodo

returns.std()

1

2

3

4

5

6

7

8

Bank Ticker

BAC Return 0.036647

C Return 0.038672

GS Return 0.025390

JPM Return 0.027667

MS Return 0.037819

WFC Return 0.030238

dtype: float64

1

2

3

# standard deviation sul 2015 (filtro o apply con map sull'index)

# returns[returns.index.map(lambda x: x.year)==2015].std()

returns.loc['2015-01-01':'2015-12-31'].std()

1

2

3

4

5

6

7

8

Bank Ticker

BAC Return 0.016163

C Return 0.015289

GS Return 0.014046

JPM Return 0.014017

MS Return 0.016249

WFC Return 0.012591

dtype: float64

1

2

3

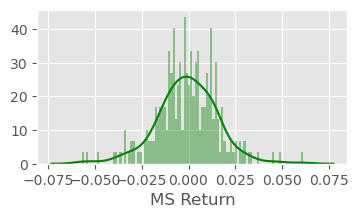

# distplot return del 2015 di MS

plt.figure(figsize=(4,2),dpi=100)

sns.distplot(returns.loc['2015-01-01':'2015-12-31']['MS Return'],bins=100,color='green')

1

<matplotlib.axes._subplots.AxesSubplot at 0x7ff6cf835e50>

1

2

3

# distplot return del 2015 di C

plt.figure(figsize=(4,2),dpi=100)

sns.distplot(returns.loc['2008-01-01':'2008-12-31']['C Return'],bins=100,color='red')

1

<matplotlib.axes._subplots.AxesSubplot at 0x7ff6ce6f98d0>

More Visualization

1

2

3

4

5

6

7

8

9

10

import matplotlib.pyplot as plt

import seaborn as sns

sns.set_style('whitegrid')

%matplotlib inline

import plotly

import cufflinks as cf

cf.go_offline()

from IPython.display import Image

1

2

3

# close stock per ogni banca

close = bank_stocks.xs(key='Close',level='Stock Info',axis=1)

close.head()

| Bank Ticker | BAC | C | GS | JPM | MS | WFC |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2006-01-03 | 47.080002 | 492.899994 | 128.869995 | 40.189999 | 58.310001 | 31.900000 |

| 2006-01-04 | 46.580002 | 483.799988 | 127.089996 | 39.619999 | 58.349998 | 31.530001 |

| 2006-01-05 | 46.639999 | 486.200012 | 127.040001 | 39.740002 | 58.509998 | 31.495001 |

| 2006-01-06 | 46.570000 | 486.200012 | 128.839996 | 40.020000 | 58.570000 | 31.680000 |

| 2006-01-09 | 46.599998 | 483.899994 | 130.389999 | 40.669998 | 59.189999 | 31.674999 |

1

2

3

4

5

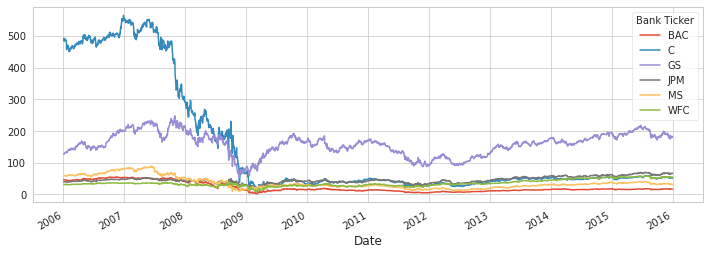

# line plot per ogni close stock (matplotlib)

close.plot(figsize=(12,4))

# for tick in tickers:

# bank_stocks[tick]['Close'].plot(figsize=(12,4),label=tick)

# plt.legend()

1

<matplotlib.axes._subplots.AxesSubplot at 0x7ff6df437790>

1

2

3

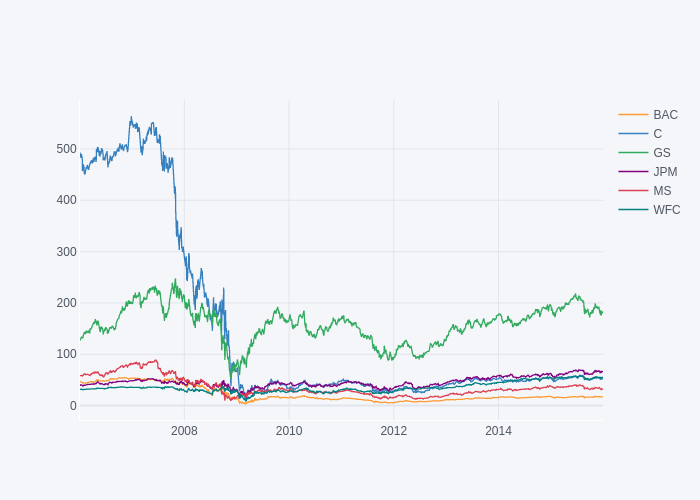

# line plot per ogni close stock (plotly)

fig = close.iplot(asFigure=True)

fig.show()

1

2

3

# display static image

img_bytes = fig.to_image(format="png")

Image(img_bytes)

Moving Averages

1

2

3

4

5

6

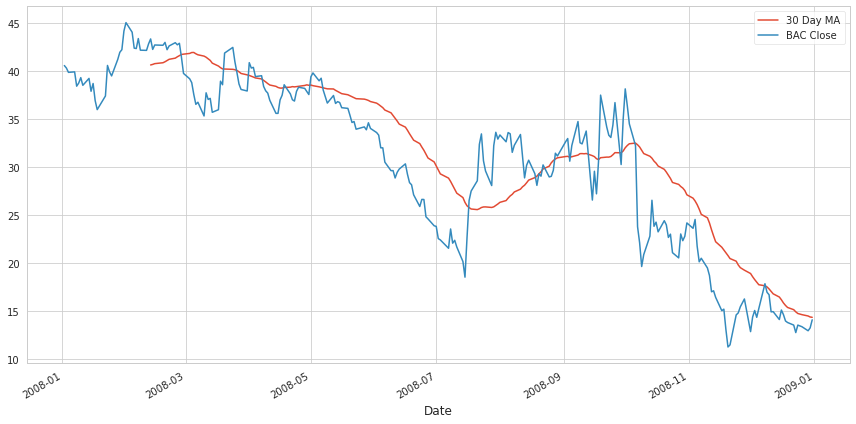

# close stock BAC e MA 30 giorni

fig = plt.figure(figsize=(12,6))

close.loc['2008-01-01':'2008-12-31']['BAC'].rolling(window=30).mean().plot(label='30 Day MA')

close.loc['2008-01-01':'2008-12-31']['BAC'].plot(label='BAC Close')

plt.legend()

plt.tight_layout()

1

2

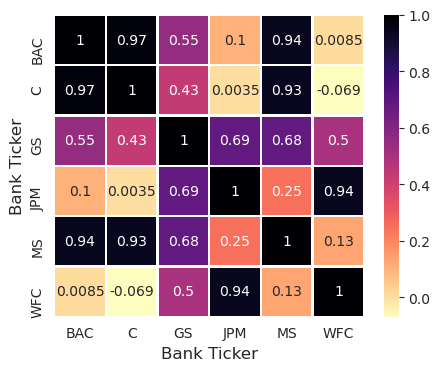

3

# heatmap close price (reversescale color)

plt.figure(figsize=(5,4),dpi=100)

sns.heatmap(close.corr(),cmap='magma_r',linecolor='white',linewidths=1,annot=True)

1

<matplotlib.axes._subplots.AxesSubplot at 0x7ff6daa16210>

1

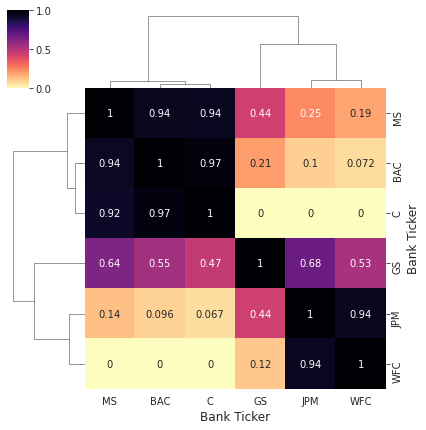

2

# clustermap close price

sns.clustermap(close.corr(),standard_scale=1,figsize=(6,6),annot=True,cmap='magma_r')

1

<seaborn.matrix.ClusterGrid at 0x7ff6da90a1d0>

Technical Analysis

1

2

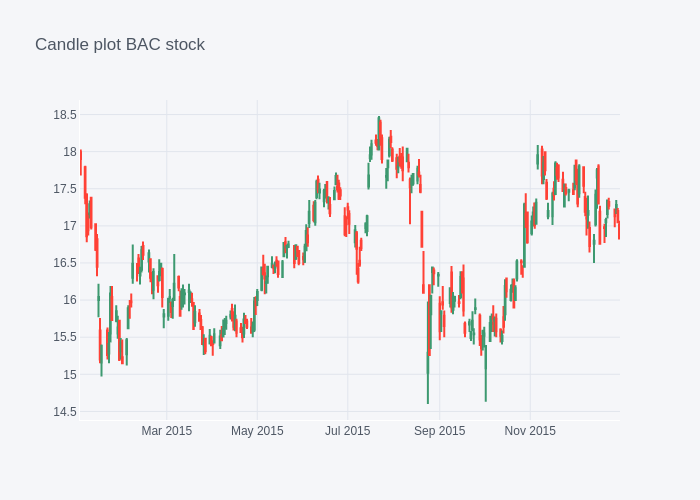

3

# candle plot BAC

fig = BAC[['Open', 'High', 'Low', 'Close']].loc['2015-01-01':'2016-01-01'].iplot(kind='candle',asFigure=True,title='Candle plot BAC stock')

fig.show()

1

2

3

# display static image

img_bytes = fig.to_image(format="png")

Image(img_bytes)

1

2

# Simple Moving Average per MS (da lanciare in locale, non sono riuscito ad esportarla come immagine)

MS['Close'].loc['2015-01-01':'2016-01-01'].ta_plot(study='sma',periods=[13,21,55])

1

2

# Bollinger Band Plot per BAC

BAC['Close'].loc['2015-01-01':'2016-01-01'].ta_plot(study='boll')